Class Action Settlement Recovery

Claim Your Share of $5.54 Billion in this Card Brand Settlement

You may be entitled to your share of the FTC ruling, but only if you claim it by August 30, 2024!

Class Action Settlement Recovery

Claim Your Share of $5.54 Billion in this Card Brand Settlement

You may be entitled to your share of the FTC ruling, but only if you claim it by August 30, 2024!

This settlement is available to all persons, businesses, and other entities that have accepted any Visa-Branded Cards and/or MasterCard-Branded cards in the United States at any time from January 1, 2004 to January 25, 2019.

Payment Card Interchange Fee Settlement (Visa TM MasterCard TM Settlement)

Amount: Up To $5.54B

Class Period: Jan 1, 2024 - Jan 25, 2019

Claim Filing DEADLINE: August 30, 2024

Payment Card Interchange Fee Settlement (Visa TM MasterCard TM Settlement)

Amount: Up To $5.54B

Class Period: Jan 1, 2024 - Jan 25, 2019

Claim Filing DEADLINE: August 30, 2024

WARNING

If you do not file a claim by August 30, 2024, you CANNOT receive money from this settlement.

WARNING

If you do not file a claim by August 30, 2024, you CANNOT receive money from this settlement.

Payment Card Interchange Fee Settlement

Reclaim Excessive Fees Paid

January 1, 2004 - January 25, 2019

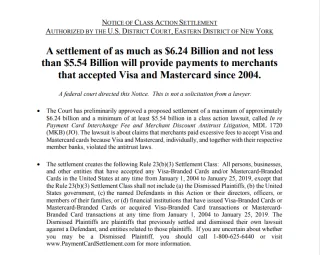

Class action lawsuit settled for $5.5 Billion

The lawsuit is about claims that merchants paid excessive fees to accept Visa and Mastercard cards because Visa and Mastercard, individually, and together with their respective member banks, violated the antitrust laws.

Visa & MasterCard

Offset Other Business Income

Visa

MasterCard

Any of their associated branded cards

This lawsuit is principally about the interchange fees attributable to merchants that accepted Visa or Mastercard credit or debit cards between January 1, 2004 and January 25, 2019, and Visa’s and Mastercard’s rules for merchants that have accepted those cards.

Billions Go Unclaimed

Don't Miss Out

Since 2010, more than $75 billion has been set aside for consumers and businesses.

We calculate your maximum settlement

Sign up in as little as 90 seconds

Millions of eligible claimants miss out on collecting from billions of dollars in settlement awards — simply because they fail to file.

Payment Card Interchange Fee Settlement

Reclaim Excessive Fees Paid

January 1, 2004 - January 25, 2019

Class action lawsuit settled for $5.5 Billion

The lawsuit is about claims that merchants paid excessive fees to accept Visa and Mastercard cards because Visa and Mastercard, individually, and together with their respective member banks, violated the antitrust laws.

Visa & MasterCard

Offset Other Business Income

Visa

MasterCard

Any of their associated branded cards

This lawsuit is principally about the interchange fees attributable to merchants that accepted Visa or Mastercard credit or debit cards between January 1, 2004 and January 25, 2019, and Visa’s and Mastercard’s rules for merchants that have accepted those cards.

Billions Go Unclaimed

Don't Miss Out

Since 2010, more than $75 billion has been set aside for consumers and businesses.

We calculate your maximum settlement

Sign up in as little as 90 seconds

Millions of eligible claimants miss out on collecting from billions of dollars in settlement awards — simply because they fail to file.

Simple Process

1. We Match

We determine your maximum settlement and identify any other available settlements.

3. You Collect

You collect the money you’re entitled to.

2. We File

We file on your behalf and keep you updated every step of the way.

4. We Monitor

We monitor and identify new settlements your business may be eligible for

What is this lawsuit about?

This lawsuit is principally about the interchange fees attributable to merchants that accepted Visa or Mastercard credit or debit cards between January 1, 2004 and January 25, 2019, and Visa’s and Mastercard’s rules for merchants that have accepted those cards.

The Rule 23(b)(3) Class Plaintiffs claim that:

Visa, and its respective member banks, including the Bank Defendants, violated the law because they set interchange fees.

Mastercard and its respective member banks, including the Bank Defendants, violated the law because they set interchange fees.

Visa and its respective member banks, including the Bank Defendants, violated the law because they imposed and enforced rules that limited merchants from steering their customers to other payment methods. Those rules include so-called no-surcharge rules, no-discounting rules, honor-all-cards rules, and certain other rules. Doing so insulated them from competitive pressure to lower the interchange fees.

Mastercard and its respective member banks, including the Bank Defendants, violated the law because they imposed and enforced rules that limited merchants from steering their customers to other payment methods. Those rules include so-called no-surcharge rules, no-discounting rules, honor-all-cards rules, and certain other rules. Doing so insulated them from competitive pressure to lower the interchange fees.

Visa and Mastercard conspired together about some of the business practices challenged.

Visa and its respective member banks continued in those activities despite the fact that Visa changed its corporate structure and became a publicly owned corporation after this case was filed.

Mastercard and its respective member banks continued in those activities despite the fact that Mastercard changed its corporate structure and became a publicly owned corporation after this case was filed.

The Defendants’ conduct caused the merchants to pay excessive interchange fees for accepting Visa and Mastercard cards.

But for Defendants’ conduct there would have been no interchange fee or those fees would have been lower.

The Defendants say they have done nothing wrong. They claim their business practices are legal, justified, the result of independent competition and have benefitted merchants and consumers.

Why did I get a notice?

The Notice tells you about your rights and options in a class action lawsuit in the U.S. District Court for the Eastern District of New York. Judge Margo K. Brodie and Magistrate Judge James Orenstein are overseeing this class action, which is called In re Payment Card Interchange Fee and Merchant Discount Antitrust Litigation, MDL No. 1720 (MKB) (JO). The Notice also explains the lawsuit, the proposed settlement, the benefits available, eligibility for those benefits, and how to get them.

The companies or entities who started this case are called the “Plaintiffs.” The companies they are suing are the “Defendants.”

This case has been brought on behalf of merchants. The specific merchants that filed the case are the Rule 23(b)(3) Class Plaintiffs and the Court has authorized them to act on behalf of all merchants in the class described below in connection with the proposed settlement of this case. The Rule 23(b)(3) Class Plaintiffs are:

Photos Etc. Corporation DBA ScanMyPhotos.Com; Traditions, Ltd.; Capital Audio Electronics, Inc.; CHS Inc.; Discount Optics, Inc.; Leon’s Transmission Service, Inc.; Parkway Corporation; and Payless Inc.

The companies that the plaintiffs have been suing are the “Defendants.” Defendants are:

Network Defendants:“Visa”: Visa U.S.A. Inc., Visa International Service Association, and Visa Inc.; and“Mastercard”: Mastercard International Incorporated and Mastercard Incorporated; and

Bank Defendants: Bank of America, N.A.; BA Merchant Services LLC (formerly known as National Processing, Inc.); Bank of America Corporation; Barclays Bank plc; Barclays Delaware Holdings, LLC (formerly known as Juniper Financial Corporation); Barclays Bank Delaware (formerly known as Juniper Bank); Barclays Financial Corp.; Capital One Bank (USA), N.A.; Capital One F.S.B.; Capital One Financial Corporation; Chase Bank USA, N.A. (and as successor to Chase Manhattan Bank USA, N.A. and Bank One, Delaware, N.A.); Paymentech, LLC (and as successor to Chase Paymentech Solutions, LLC); JPMorgan Chase & Co. (and as successor to Bank One Corporation); JPMorgan Chase Bank, N.A. (and as successor to Washington Mutual Bank); Citibank, N.A.; Citigroup Inc.; Citicorp; Fifth Third Bancorp; First National Bank of Omaha; HSBC Finance Corporation; HSBC Bank USA, N.A.; HSBC North America Holdings Inc.; HSBC Holdings plc; HSBC Bank plc; The PNC Financial Services Group, Inc. (and as acquirer of National City Corporation); National City Corporation; National City Bank of Kentucky; SunTrust Banks, Inc.; SunTrust Bank; Texas Independent Bancshares, Inc.; and Wells Fargo & Company (and as successor to Wachovia Corporation).

What is an interchange fee?

When a cardholder makes a purchase with a credit or debit card, there is an interchange fee attributable to those transactions, which is usually around 1% to 2% of the purchase price. Interchange fees typically account for the greatest part of the fees paid by merchants for accepting Visa and Mastercard cards.

Visa and Mastercard set interchange fee rates for different kinds of transactions and publish them on their websites, usually twice a year.

Why is this a class action?

In a class action, people or businesses sue not only for themselves, but also on behalf of other people or businesses with similar legal claims and interests. Together all of these people or businesses with similar claims and interests form a class, and are class members.

When a court decides a case or approves a settlement, it is applicable to all members of the class (except class members who exclude themselves). In this case, the Court has granted Final Approval to the settlement and the class defined below in Question 6. An appeal to the final-approval order was filed on Friday, January 3, 2020. The Settlement received final approval by the district court. The Second Circuit Court of Appeals heard oral arguments and affirmed all aspects of the District Court’s final approval order save one. The time for all appeals has passed.

Why is there a settlement?

The Court has not decided which side was right or wrong or if any laws were violated. Instead, both sides agreed to settle the case and avoid the cost and risk of trial and appeals that would follow a trial.

In this case, the settlement is the product of extensive negotiations, including mediation before two experienced mediators, chosen by the parties. Settling this case allows class members to receive payments. The Rule 23(b)(3) Class Plaintiffs and their lawyers believe the settlement is best for all class members.

The parties agreed to settle this case only after thirteen years of extensive litigation. During discovery, Rule 23(b)(3) Class Plaintiffs reviewed and analyzed more than 60 million pages of documents and participated in more than 550 depositions, including fact and expert depositions. Also, earlier in this litigation, motions to dismiss, motions for summary judgment, motions to exclude expert testimony, and the motion for class certification had been fully briefed and argued, but not decided by the Court.

Am I part of this settlement?

If you received a Notice in the mail, the Defendants’ records show that you are probably in the Rule 23(b)(3) Settlement Class, consisting of:

All persons, businesses, and other entities that have accepted any Visa-Branded Cards and/or Mastercard-Branded Cards in the United States at any time from January 1, 2004 to January 25, 2019, except that the Rule 23(b)(3) Settlement Class shall not include (a) the Dismissed Plaintiffs, (b) the United States government, (c) the named Defendants in this Action or their directors, officers, or members of their families, or (d) financial institutions that have issued Visa-Branded Cards or Mastercard-Branded Cards or acquired Visa-Branded Card transactions or Mastercard-Branded Card transactions at any time from January 1, 2004 to January 25, 2019.

The Dismissed Plaintiffs are plaintiffs that previously settled and dismissed their own lawsuit against a Defendant; those plaintiffs are listed in Appendix B to the Class Settlement Agreement, which is available here. The Dismissed Plaintiffs also include entities related to the plaintiffs listed in Appendix B. If you are uncertain about whether you may be a Dismissed Plaintiff, you should call 1-800-625-6440 or view Appendix B here for more information.

How much money will I get?

The amount paid from the settlement fund will be based on your actual or estimated interchange fees attributable to Visa and Mastercard card transactions (between you and your customers) from January 1, 2004, through January 25, 2019.

The amount of money each Authorized Claimant will receive from the settlement fund depends on the money available to pay all claims, the total dollar value of all valid claims filed, the cost of class administration and notice, applicable taxes on the settlement fund and any other related tax expenses, attorneys’ fees and expenses, and money awards to the Rule 23(b)(3) Class Plaintiffs for their representation of merchants in MDL 1720, which culminated in the Class Settlement Agreement, all as approved by the Court.

When will I get paid?

No payments are expected to be made until after the end of the Claims Period on May 31, 2024. Because the pro rata cannot be determined until all Claims are filed and reviewed and until the Court approves the final amounts, we do not yet know when payments will be made. Please be patient.

What happens if I do nothing?

If you do not file a claim, you cannot get money from this settlement.

What is the full text of the Release for the Rule 23(b)(3) Settlement Class?

For the full release and all the terms of the Settlement, please review the Superseding and Amended Class Settlement Agreement, available here.

Still Have Questions?

Looking For Ways to Reduce Costs at Your Business ?

Our team of experts has extensive experience crafting customized, affordable solutions and supporting businesses of all sizes.

About My Business Concierge

As the premier business consulting group nationwide, My Business Concierge is dedicated to introducing innovative solutions that lower overhead, minimize tax liability, and fuel business growth.

Disclaimer: Collectively and My Business Concierge LLC are not law firms and do not give legal advice. Collectively is not associated with the class administrator, the court, class counsel or any other official parties. You do not have to hire a third-party claims consultant and are entitled to file your claim on your own without incurring any fee. For The Payment Card Settlement Only: Claim forms will begin to be delivered and available online in December. No-cost assistance is available from the Class Administrator and Class Counsel during the claims-filing period. No one is required to sign up with any third-party service in order to participate in any monetary relief. For additional information regarding the status of the litigation, interested persons may visit www.paymentcardsettlement.com, the Court-approved website for this case.

© 2024 | Privacy Policy

About My Business Concierge

As the premier business consulting group nationwide, My Business Concierge is dedicated to introducing innovative solutions that lower overhead, minimize tax liability, and fuel business growth.

Disclaimer: Collectively and My Business Concierge LLC are not law firms and do not give legal advice. Collectively is not associated with the class administrator, the court, class counsel or any other official parties. You do not have to hire a third-party claims consultant and are entitled to file your claim on your own without incurring any fee. For The Payment Card Settlement Only: Claim forms will begin to be delivered and available online in December. No-cost assistance is available from the Class Administrator and Class Counsel during the claims-filing period. No one is required to sign up with any third-party service in order to participate in any monetary relief. For additional information regarding the status of the litigation, interested persons may visit www.paymentcardsettlement.com, the Court-approved website for this case.