Your Commercial Real Estate Portfolio Could Be Owed Millions

Our partner, StormChecks, helps property owners uncover hidden storm damage and unlock the full value of their insurance claims. With decades of experience and a proven track record, we handle everything—from inspection to negotiation—so you get the recovery you deserve. No upfront costs. Just maximum payouts.

$20B+ Recovered

For Our Customers

70,000+

Customers Served

$20B+ Recovered

For Our Customers

70,000+

Customers Served

Who We Help

From single-property owners to major investors, we help uncover hidden claims, ease financial pressure, and unlock real value—especially for storm-prone and undervalued properties.

Owners Under Financial Pressure

Those squeezed by high interest rates and tight cash flow.

Undervalued Assets

Properties with hidden value, from older buildings (pre-1979) to those in storm-prone areas.

All Sizes Welcome

Not just single-property owners—many of our best clients are large portfolio owners, such as REITs and major family offices.

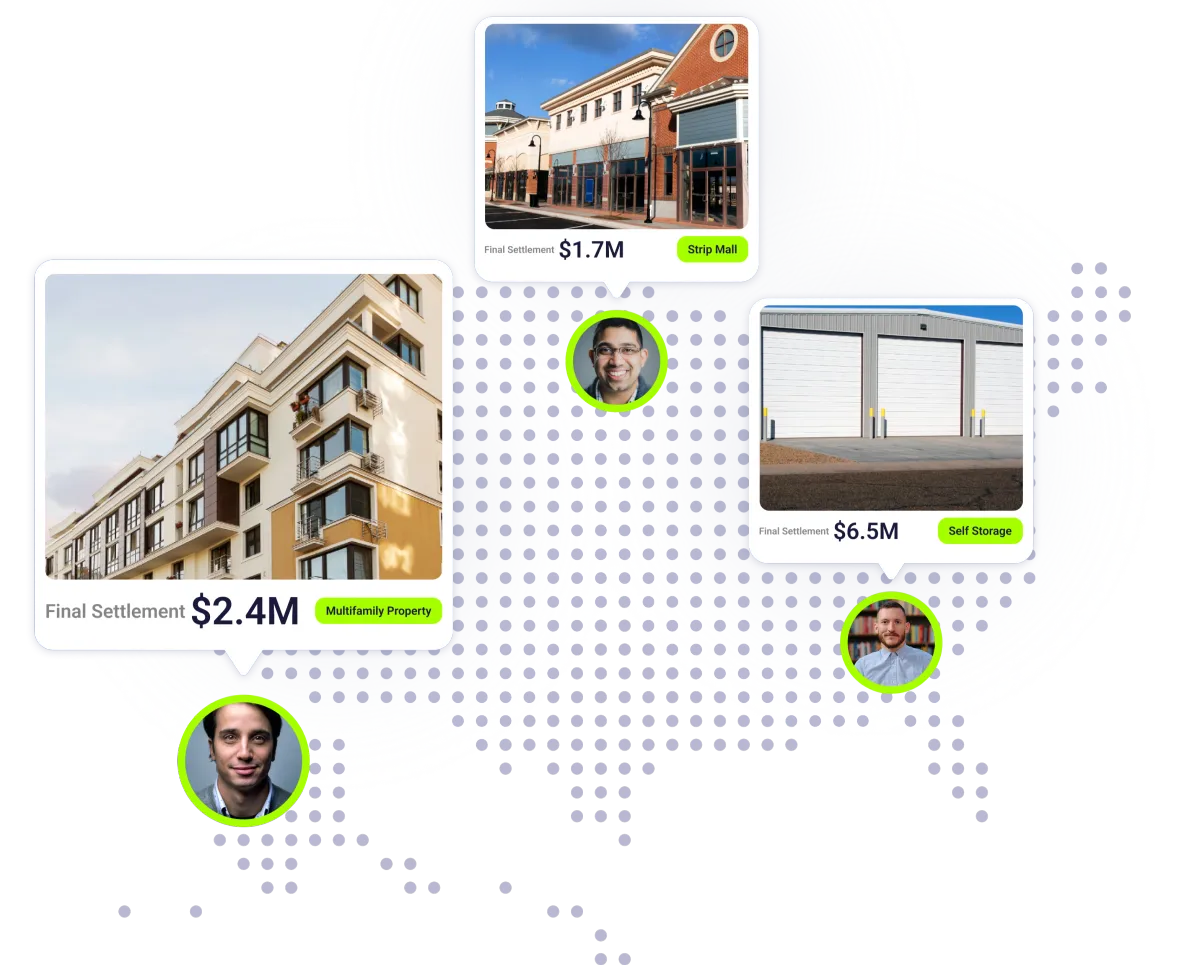

Real Property Owners. Real Recoveries.

Every storm leaves behind more than just wind and water damage—it leaves hidden financial opportunities. Our proven track record shows how we help property owners uncover and claim what they’re truly owed.

Real Property Owners. Real Recoveries.

Every storm leaves behind more than just wind and water damage—it leaves hidden financial opportunities. Our proven track record shows how we help property owners uncover and claim what they’re truly owed.

Professional Recovery Process

Professional Recovery Process

Strategic approach to maximizing your property's value

Step 1: Free Portfolio Assessment

We uncover hidden opportunities—without disrupting your day.

We review your portfolio to see if your properties qualify.

Our tech identifies past storms that may have impacted your properties.

We perform a high-level evaluation to spot potential hidden damage.

If we find value, we develop a tailored plan to help you recover it.

Step 2: Expert Consultation

We confirm what’s hidden and document every detail.

Our experts do a thorough, on-site review.

We collect and organize the evidence your insurer needs.

We determine the potential recovery you’re entitled to.

We create a step-by-step plan to maximize your claim.

Step 3: Results-Driven Implementation

We handle the heavy lifting, so you can focus on your business.

We prepare and submit your claim with precision.

We negotiate on your behalf to secure the maximum settlement.

We keep you informed with clear, timely updates.

You receive the funds you’re owed—unlocking hidden value and cash flow.

Ready To Get Started?

Already Filed Or Denied A Claim?

Already Filed Or Denied A Claim?

If you’ve already received a payout or had your claim denied, you may still be leaving significant money on the table.

We specialize in reviewing underpaid and denied claims—even if you’ve already settled. You keep 100% of what you’ve already received, and our fee only applies to any additional recovery we secure. For example, if your original offer was $200,000 and we recover $1,000,000, you keep the full $200,000—our fee only applies to the additional $800,000.

Our team has deep insider experience with insurance company tactics, giving us a unique advantage when it comes to reopening claims and negotiating better outcomes. If your claim was denied, we’ll dig into the details and fight for the fair resolution you deserve

If you’ve already received a payout or had your claim denied, you may still be leaving significant money on the table.

We specialize in reviewing underpaid and denied claims—even if you’ve already settled. You keep 100% of what you’ve already received, and our fee only applies to any additional recovery we secure. For example, if your original offer was $200,000 and we recover $1,000,000, you keep the full $200,000—our fee only applies to the additional $800,000.

Our team has deep insider experience with insurance company tactics, giving us a unique advantage when it comes to reopening claims and negotiating better outcomes. If your claim was denied, we’ll dig into the details and fight for the fair resolution you deserve

Free 24/7 Storm Monitoring

Free 24/7 Storm Monitoring

Most real estate investors don’t live near their properties, which means storm damage often goes unnoticed—and 95% of valuable claims go unfiled.

Our free monitoring system tracks storms around the clock across all your locations and instantly alerts you when your property may qualify for a claim. It’s hands-off, hassle-free, and ensures you never miss an opportunity to recover what you’re owed.

Most real estate investors don’t live near their properties, which means storm damage often goes unnoticed—and 95% of valuable claims go unfiled.

Our free monitoring system tracks storms around the clock across all your locations and instantly alerts you when your property may qualify for a claim. It’s hands-off, hassle-free, and ensures you never miss an opportunity to recover what you’re owed.

Free continuous storm tracking across all your properties

Instant alerts when damage may qualify for a claim

Prevents missed claims and lost recovery dollars

Already Filed Or Denied A Claim?

Already Filed Or Denied A Claim?

If you’ve already received a payout or had your claim denied, you may still be leaving significant money on the table.

We specialize in reviewing underpaid and denied claims—even if you’ve already settled. You keep 100% of what you’ve already received, and our fee only applies to any additional recovery we secure. For example, if your original offer was $200,000 and we recover $1,000,000, you keep the full $200,000—our fee only applies to the additional $800,000.

Our team has deep insider experience with insurance company tactics, giving us a unique advantage when it comes to reopening claims and negotiating better outcomes. If your claim was denied, we’ll dig into the details and fight for the fair resolution you deserve

If you’ve already received a payout or had your claim denied, you may still be leaving significant money on the table.

We specialize in reviewing underpaid and denied claims—even if you’ve already settled. You keep 100% of what you’ve already received, and our fee only applies to any additional recovery we secure. For example, if your original offer was $200,000 and we recover $1,000,000, you keep the full $200,000—our fee only applies to the additional $800,000.

Our team has deep insider experience with insurance company tactics, giving us a unique advantage when it comes to reopening claims and negotiating better outcomes. If your claim was denied, we’ll dig into the details and fight for the fair resolution you deserve

Free 24/7 Storm Monitoring

Free 24/7 Storm Monitoring

Most real estate investors don’t live near their properties, which means storm damage often goes unnoticed—and 95% of valuable claims go unfiled.

Our free monitoring system tracks storms around the clock across all your locations and instantly alerts you when your property may qualify for a claim. It’s hands-off, hassle-free, and ensures you never miss an opportunity to recover what you’re owed.

Most real estate investors don’t live near their properties, which means storm damage often goes unnoticed—and 95% of valuable claims go unfiled.

Our free monitoring system tracks storms around the clock across all your locations and instantly alerts you when your property may qualify for a claim. It’s hands-off, hassle-free, and ensures you never miss an opportunity to recover what you’re owed.

Free continuous storm tracking across all your properties

Instant alerts when damage may qualify for a claim

Prevents missed claims and lost recovery dollars

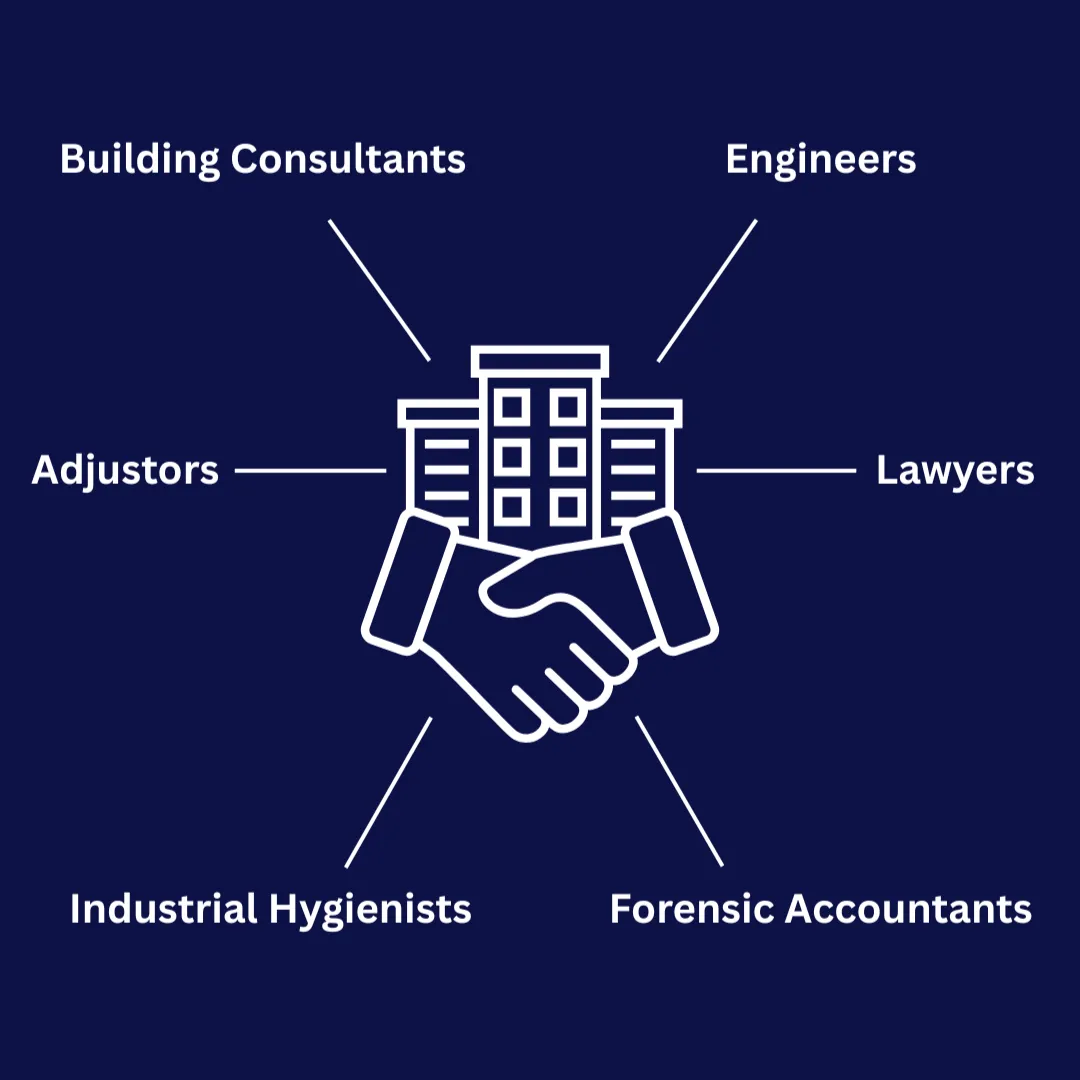

Founded by Former Insurance Insiders—Now on Your Side

The tax deduction is triggered if building design improvements result in efficiency of at least 25 percent.

Our partner's spent their careers in the insurance industry, where their primary role was to minimize or deny claims from commercial real estate owners. But after seeing how often building owners were unknowingly leaving significant money on the table after storms, they chose to switch sides.

Today, we’ve built a team of seasoned building advisors committed to turning your insurance policy from a sunk cost into a powerful asset. With us on your side, you’ll have industry insiders working to uncover hidden damage, fight for your full entitlement, and help you secure the maximum payout you deserve.

3 Simple Steps to Recovery

Get the compensation you deserve effortlessly.

Enter Your Contact Information

Provide property addresses for our software to analyze storm history.

Our Team Evaluate Your Property

We evaluate for hidden storm damage.

We Handle The Rest

Once the property evaluation is complete, you'll receive a detailed report on your property's storm damage and potential claims.

How It Works (Simple 3-Step Process)

Getting started is easy. Our process ensures you uncover hidden claims with minimal effort, so you can focus on managing your portfolio while we handle the heavy lifting.

Enter Your Contact Information

Submit your name and portfolio details.

Our Team Evaluate Your Property

We evaluate for hidden storm damage.

We Handle The Rest

Once the property evaluation is complete, you'll receive a detailed report on your property's storm damage and potential claims.

Ready To Get Started?

FAQ

How do you differ from insurance adjusters?

We are building consultants who specialize in maximizing insurance claim recoveries for commercial property owners. Unlike insurance adjusters who work for the insurance company, we work exclusively for you, the property owner, to maximize your settlement.

What makes our service different than other consultants?

Our processors spent over two decades inside the insurance industry minimizing claim payouts for insurance companies. After seeing countless property owners left under-compensated, he decided to switch sides and help property owners instead. We leverage this insider knowledge of insurance company tactics and strategies to maximize settlements for our clients.

What types of properties do you work with?

We specialize in large commercial properties, including:

Office buildings and complexes

Retail centers

Industrial facilities

Multi-family complexes

Healthcare facilities

Educational institutions

REIT portfolios

Are your services available nationwide?

Yes, we work with commercial property owners across all 50 states.

Are there any upfront costs or additional fees?

No. There are no upfront costs, attorney fees, or hidden charges. You only pay our percentage if and when we secure a settlement for you.

Can you help if I've already received an offer from my insurance company?

Yes. You keep 100% of what you've already received, and our fee only applies to any additional amount we secure above the initial offer. For example, if you were initially offered $200,000 and we secure $1,000,000, you keep the full $200,000 and our fee only applies to the additional $800,000 we recovered.

About My Business Concierge

My Business Concierge is dedicated to introducing innovative solutions that helping businesses of all sizes lower overhead, maximize profitability, boost employee retention, and fuel business growth.

My Business Conciege, LLC DOES NOT provide any legal or accounting advice and users of this web site should consult with their own lawyer and C.P.A. for legal and accounting advice.

About My Business Concierge

My Business Concierge is dedicated to introducing innovative solutions that help businesses of all sizes lower overhead, maximize profitability, boost employee retention, and fuel business growth.

My Business Conciege, LLC DOES NOT provide any legal or accounting advice and users of this web site should consult with their own lawyer and C.P.A. for legal and accounting advice.